Ukrainian IT export completed the year 2025 with moderate but fundamentally important growth. December was the key factor, providing a sharp monthly surge and significantly boosting the final figures. Against this backdrop, Israel secured its position in the top five largest markets for Ukrainian IT exports, confirming its status as one of the most stable and technologically intensive partners.

December surge that pulled the year

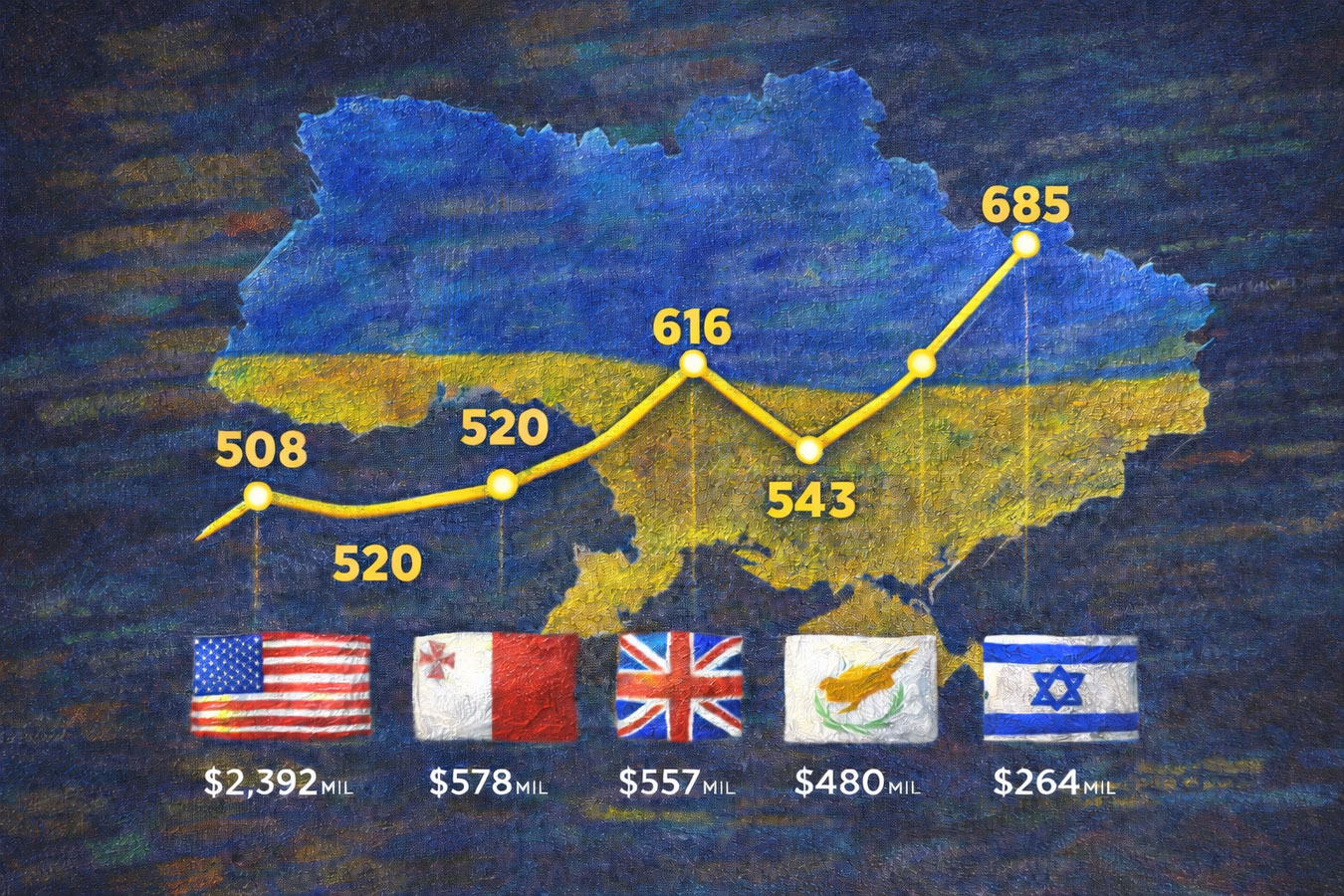

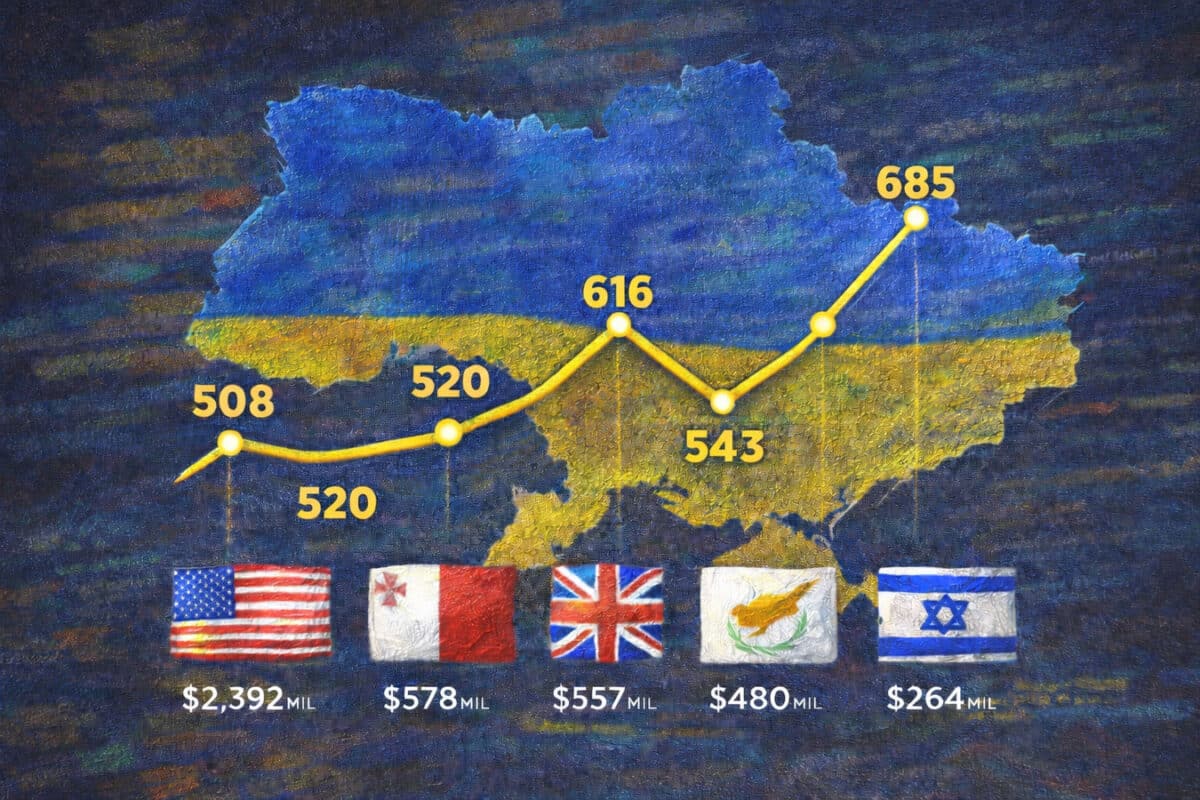

In December 2025, IT service exports from Ukraine reached $685 million. Compared to November, the increase amounted to $142 million, or +26.2% month-on-month — the strongest result of the year.

In annual comparison, December also showed a positive trend. In December 2024, the figure was $616 million, meaning the annual growth reached $69 million, or +11.2%. These data are provided with reference to the statistics of the National Bank of Ukraine.

This is reported by Danylo Hetmantsev (Chairman of the Verkhovna Rada Committee on Finance, Tax and Customs Policy) with reference to NBU statistics.

Results of 2025: cautious growth without records

For the entire year of 2025, IT service exports amounted to $6.656 billion. This is $210 million more than in 2024 ($6.446 billion), which corresponds to +3.3% year-on-year.

At the same time, the industry has not yet returned to the level of 2022, when the volume of IT exports reached $7.349 billion. Therefore, it is more accurate to speak of stabilization and gradual recovery after a sharp decline rather than a new record.

Largest markets for Ukrainian IT exports in 2025

The geography of IT exports in 2025 showed resilience and relative diversification. The top five leaders are as follows.

Top-5 markets

USA — $2.392 billion

Malta — $578 million

United Kingdom — $557 million

Cyprus — $480 million

Israel — $264 million

Israel confidently took fifth place, maintaining its position among the key destinations for Ukrainian IT exports for the second consecutive year.

Other significant markets: Europe and the Middle East

In addition to the top five, other markets that form the “second tier” of the export structure made a noticeable contribution in 2025.

Significant IT export destinations

Switzerland — $248 million

Germany — $237 million

Estonia — $216 million

Poland — $190 million

UAE — $169 million

This list shows that Ukrainian IT companies continue to actively work with continental Europe and countries with developed financial and technological infrastructure.

Why Israel remains a key market

The Israeli market is characterized by a relatively small volume but a high concentration of technological projects. For Ukrainian IT teams, this means demand not only for classic outsourcing but also for R&D, cybersecurity, engineering solutions, and dual-use products.

In this context, NAnews — Israel News | Nikk.Agency emphasize: Israel’s position in the top five is an indicator of the quality of export demand, not just the volume of contracts.

Defense tech as a potential driver for 2026

A separate emphasis in the analysis of 2025 is placed on the direction of defense tech. Experts see potential for accelerated IT export growth here.

From January 2026, a special regime Defence City was launched in Ukraine, providing tax incentives, export support, and assistance with the relocation of technology companies. For the IT sector, this could become one of the key growth factors in the coming quarters.

What the market records at the start of 2026

The year 2025 was transitional. IT exports showed a small increase compared to 2024 but still remain below the level of 2022. December showed that growth potential remains, but it is realized unevenly and heavily depends on external markets.

Israel, maintaining fifth place among the largest destinations for Ukrainian IT exports, remains one of the most stable and strategically important partners. It is such markets, focused on complex technologies and long-term projects, that will determine the trajectory of the industry in 2026 and beyond.